Not for distribution to United States news wire services or for dissemination in the United States.

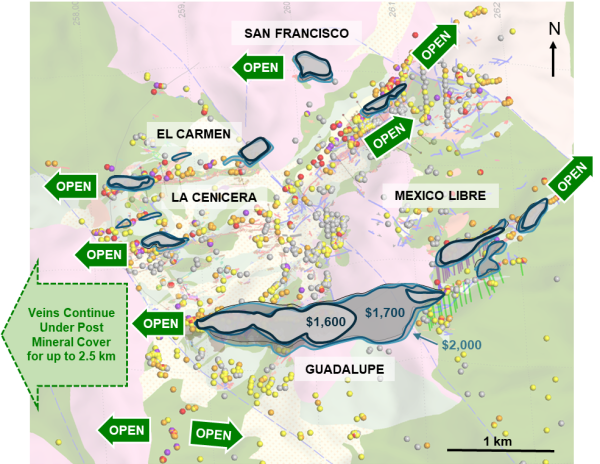

Vancouver, British Columbia – October 30, 2023 – Atacama Copper Corporation (TSXV: ACOP) (“Atacama” or the “Company”) and TCP1 Corporation (“TCP1”) are pleased to report the results of a maiden mineral resource estimate (“MRE”) at TCP1’s wholly-owned Cristina polymetallic vein project in southwestern Chihuahua State, Mexico (see Figure 1). The Cristina project consists of multiple outcropping quartz veins that are frequently greater than 10 m in width, and extend for a currently known strike length of up to 5 km. At least four parallel mineralized vein structures have been mapped to date, however most of the resource estimate reported here is contained within the Guadalupe vein structure (Figure 2). Atacama and TCP1 recently announced a proposed business combination whereby the Company will acquire, directly or indirectly, all the issued and outstanding shares of TCP1 in exchange for common shares of the Company.

Highlights:

- Indicated resources of 17.5 Mt at 0.51 g/t gold, 33.8 g/t silver, 0.47% zinc, 0.19% lead and 0.04% copper (1.33 g/t AuEq grade), for a contained 752,000 gold-equivalent ounces.

- Inferred resources of 19.0 Mt at 0.51 g/t gold, 27.5 g/t silver, 0.50% zinc, 0.19% lead and 0.05% copper (1.27 g/t AuEq grade), for a contained 777,000 gold-equivalent ounces.

- The resource estimate is based on 220 diamond drill holes completed between 2010 and 2022 for approximately 70,000 m of drilling in total.

- Preliminary metallurgical test work suggests recoveries into concentrate of 75-85% for gold, 85-95% for silver, 80-90% for zinc and lead, and 70-80% for Cu.

The Cristina deposit is an epithermal to mesothermal vein system where the mineralisation is predominantly gold and silver, with lesser base metal values. Cristina is similar to other active mines in the region including Fresnillo’s San Julian and La Cienega mines, as well as First Majestic’s Tayoltita/San Dimas mine.

Tim Warman, Atacama’s CEO, commented “We’re extremely pleased with the maiden resource estimate for the Cristina deposit, particularly as the deposit remains open along strike and at depth, as well as in at least three other parallel mineralized veins. Once the transaction closes, we intend to continue with an aggressive drilling program at Cristina to grow the resource base, convert Inferred to Indicated, and target higher-grade shoots within the vein systems. Our technical team believes that this maiden resource may represent the tip of the iceberg at Cristina.”

Mineral Resource Estimate

The Mineral Resource Estimate for the Cristina deposit was prepared for TCP1 by Independent Mining Consultants Inc. (IMC), with an effective date of January 1, 2023. Mr. Jacob W. Richey, P.E. of IMC is the Qualified Person (“QP”) responsible for the MRE.

The Mineral Resources were established by building four 3-D block models (an open pit and underground block model in the North area and an open pit and underground block model in the south area) to estimate the in-situ mineralization. The Guadalupe vein structure is contained within the south area. Mineral Resource estimates for both models include in-situ material that meets the requirements for reasonable expectation of economic extraction either by underground mining methods or is contained within a computer-generated pit shell. Approximately 90% of the Indicated Resource tonnage, and 79% of the Inferred Resource tonnage is contained within a computer-generated pit shell.

The MRE is based on metal prices of $1700/oz Au, $23.61/oz Ag, $1.32/lb Zn, $0.94/lb Pb and $3.78/lb Cu. Open pit tonnages were tabulated as blocks above a $9.60/t Net of Smelter Return (NSR) contained within a pit shell, while underground tonnages were tabulated as blocks above $55.00/t NSR and touching at least 3 other blocks above same cutoff. Appropriate estimates for metal recoveries, treatment and refining charges were applied when calculating the NSR values.

Mining and processing inputs used to constrain the Mineral Resource estimates include process costs of $8.35/t processed, G&A of $1.00/t processed, open pit mining costs of $2.25/t of ore and $2.00/t of waste, a pit slope angle of 50 degrees and underground mining costs of $45.65/t.

Table 1: Cristina Mineral Resource Estimate

| Category | kt |

Au |

Ag |

Zn |

Pb |

Cu |

AuEq |

Au |

Ag |

Zn |

Pb |

Cu |

AuEq |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Indicated Resource | |||||||||||||

| North Area |

1,041 |

0.80 |

25.7 |

0.59 |

0.24 |

0.08 |

1.66 |

27 |

861 |

12,992 |

5,191 |

1,631 |

56 |

| South Area (primarily Guadalupe Vein) |

16,486 |

0.49 |

34.3 |

0.46 |

0.19 |

0.04 |

1.31 |

262 |

18,166 |

153,531 |

62,294 |

12,601 |

696 |

| Total Indicated |

17,527 |

0.51 |

33.8 |

0.47 |

0.19 |

0.04 |

1.33 |

288 |

19,028 |

166,523 |

67,485 |

14,231 |

752 |

| Inferred Resource | |||||||||||||

| North Area |

2,866 |

0.61 |

30.0 |

0.75 |

0.23 |

0.07 |

1.60 |

57 |

2,766 |

45,655 |

13,624 |

3,926 |

147 |

| South Area (primarily Guadalupe Vein) |

16,149 |

0.49 |

27.0 |

0.46 |

0.19 |

0.05 |

1.21 |

255 |

14,025 |

147,841 |

58,949 |

14,926 |

630 |

| Total Inferred |

19,015 |

0.51 |

27.5 |

0.50 |

0.19 |

0.05 |

1.27 |

311 |

16,791 |

193,496 |

72,572 |

18,853 |

777 |

Notes:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves. Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Numbers may not add due to rounding.

- kt are 1,000 metric tonnes; koz are 1,000 troy ounces; klbs are 1,000 imperial pounds; g/t are grams per metric tonne

- Metal Prices used: $1700/oz Au, $23.61/oz Ag, $1.32/lb Zn, $0.94/lb Pb and $3.78/lb Cu

- Gold equivalent formula: AuEq = Au + 0.014*Ag + 0.532*Zn + 0.379*Pb + 1.525*Cu (recoveries were assumed to be 100%.)

- Open pit Resources are tabulated at a cutoff grade of $9.60/t NSR; underground Resources are tabulated at a cutoff grade of $55.00/t NSR. Smelter terms and individual recoveries to concentrates are provided in the technical report; smelter terms and recoveries vary by metal grades and oxidation state. A representative equation to calculate average NSR at the above metal price for the overall Resource is provided:

- NSR $/t = Au (g/t)*($26.54/g Au) + Ag (g/t)*($0.48/g Ag) + Pb (%)*($14.53/%Pb) + Zn (%)*($18.57/%Zn) + Cu (%)*($55.08/%Cu)

Figure 1- Location map

Figure 2- Resource area pits based on gold price with surface geology and geochemical sample locations

Qualified Person

Mr. Jacob W. Richey, P.E. of IMC is the Qualified Person responsible for the MRE. Mr. Charlie Ronkos, MMSA is the Chief Operating Officer of TCP1 and the Qualified Person for the remaining technical information disclosed in this release. The QPs have reviewed and approved the technical information herein. Details of the MRE will be presented in a technical report prepared in accordance with NI 43-101 which will be available under the Company’s SEDAR profile at www.sedarplus.ca and on the Company’s website within 45 days of this news release.

About TCP1

TCP1 is a private mineral exploration company incorporated under the laws of Ontario and is based in Toronto, Ontario. TCP1 in an exploration and development company that owns 100% of the Cristina project located in Chihuahua State, Mexico and 100% of the Yecora project located in Sonora State, Mexico.

About Atacama Copper Corporation

Atacama Copper is a resource company focusing on acquiring, exploring, and developing base and precious metals properties in the Americas. It is committed to advancing the exploration and development of its Placeton/Caballo Muerto copper project in Chile while looking to increase its asset portfolio through the acquisition and development of other high-value exploration, development, and production opportunities. Atacama’s Placeton/Caballo Muerto project hosts several porphyry copper targets situated between the giant Relincho and El Morro/La Fortuna copper-gold deposits of the Nueva Union joint venture between Teck and Newmont Mining.

Additional Information – Please Contact

For more information, please contact:

Tim Warman

Chief Executive Officer and Director

Atacama Copper Corp.

Email: info@atacamacopper.ca

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the maiden resource estimate at TCP1's Cristina project; the drilling program at Cristina and the potential for MRE growth; the successful completion of the Company's proposed business combination with TCP1 and the financing proposed to be completed in connection therewith; future development plans; and the business and operations of the resulting issuer after the proposed business combination. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: failure to satisfy or waive all applicable conditions to the completion of the business combination between the Company and TCP1 (including receipt of all necessary shareholder, stock exchange and regulatory approvals or consents, and the absence of material changes with respect to the parties and their respective businesses); business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets; results of exploration; the economics of processing methods; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Atacama disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities of the Company in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.